BusinessLoans.ie is celebrating another successful finance deal. Our client was a studio specialising in live sports streaming, studio hire & localisation services. The business had been performing well, acquiring the latest studio equipment and completed a renovation. They now sported a world-class studio for their own use & to hire to corporates. They were awarded new contracts and needed €75,000 to service them. BusinessLoans.ie organised a fast finance quote at a great rate and they were happy. If your business needs a loan call us today on 01 55 636 55 or email hello@businessloans.ie.

Beauty industry business loans in Ireland

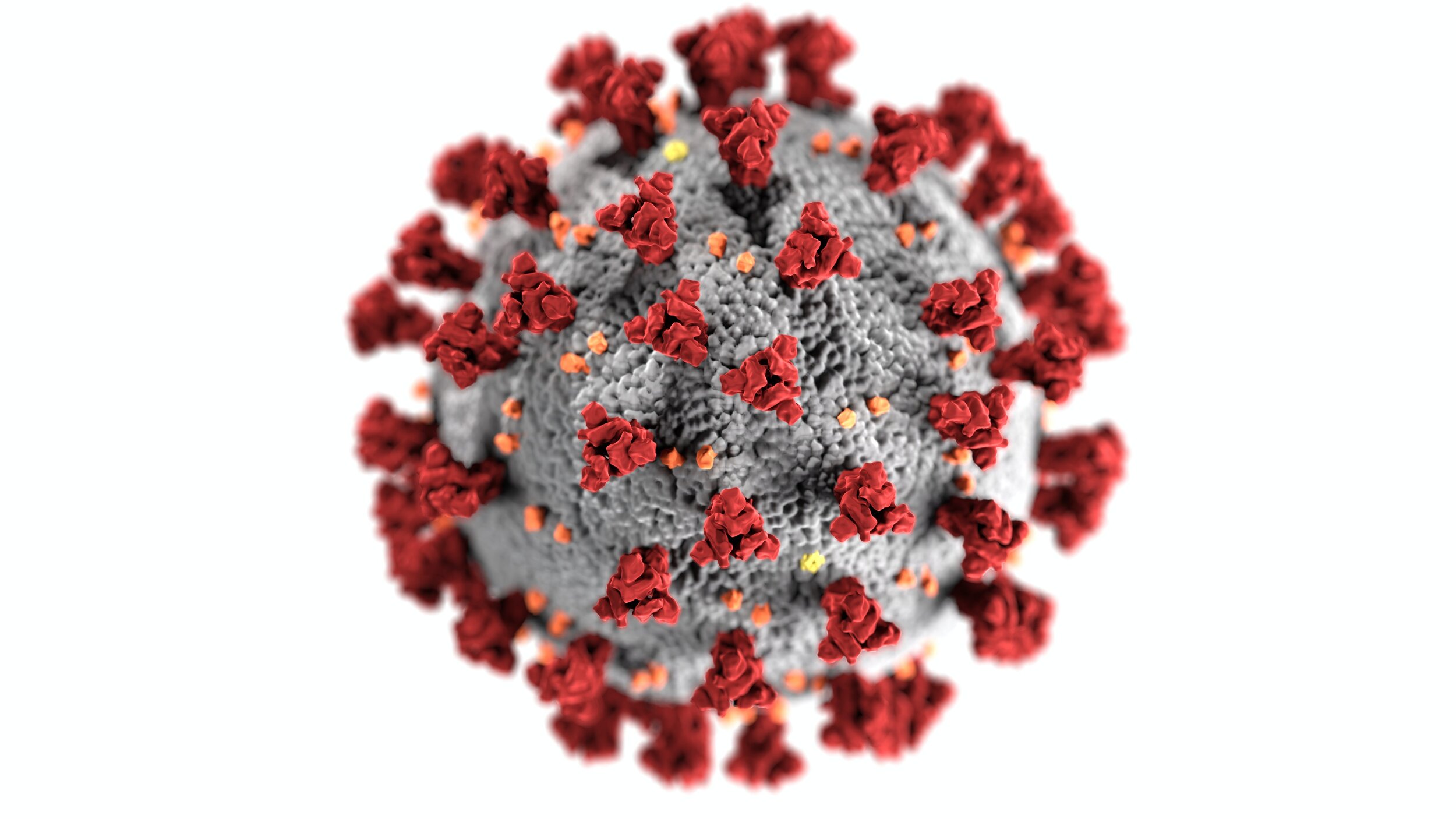

If you’re a business owner in the beauty industry, to stay ahead you need the latest equipment to serve your clients. You need a premises that looks inviting and you need the best staff. But what if your working capital has been depleted by the pandemic and everything seems out of reach? Then read on for some financing options that could help!

Simple working capital loans

If your business has been around a couple of years and your accounts are in profit then a simple unsecured loan could work. We can get you quick feedback on the maximum loan approval looking likely. Or if your accounts are not looking as good or you haven’t been in business too long but you use a card machine then a finance facility based on the volume of sales you do on your merchant account could work. This will give you flexibile & affordable finance to grow your business.

Asset finance

Your business could need some new kit whether that’s the latest hair, beauty, skincare, Covid air filtration or whatever, we have partners who can organise leasing fast. This gives you low monthly payments over a number of years with the option to hand it back and get an upgrade at end of term. It’s also possible to get you a master lease agreement. This means you can be pre-approved for an annual limit for leasing spend. If something goes kaput you have peace of mind to know you can get it replaced quickly.

BusinessLoans.ie is here for you 7 days. Email us at hello@businessloans.ie or call 01 55 636 55

Trade Finance in Ireland

Are you a B2B business that sells internationally? Are you moving in to new markets due to Brexit? Has your cash flow taken a hit due to Covid19? Then trade finance might be the solution you’re looking for. You can get your purchase orders financed & get up to 150 days of credit while getting excellent foreign exchange rates from an agile fintech that’s backed by huge bank capital. So if your business is in import & export, eCommerce, services etc. this can help you trade while conserving your day-to-day working capital.

BENEFITS FOR YOUR BUSINESS

Large credit lines with 0% deposit

Expert risk management on FX

Over 120 currencies

Fast & secure transactions

KEY CRITERIA TO ACCESS FUNDING

Your business is trading a year

Your business is turning over more than €500k

Your business is generally profitable

Your business passes the credit check

Get in touch with the business loans team to organise your line of credit today. Call us on 01 55 636 55.

3 Fast Business Loans in Ireland for 2021

If you’re starting or running a business in Ireland right now we salute you. Irish business owners are being hammered by the Brexit mess & an awful pandemic. Yet, despite this, the majority of businesses have survived and some have even thrived. You will also see the news headlines about various supports. Some have went down like a lead balloon (the hospitality keep-your-receipt tax back one with a dismal take-up) whilst others faltered at first (SBCI money through the banks with a 5% drawdown of €2 billion made available) but now are starting to take off due to the SBCI enabling some of the more agile fintechs to get in on the act. So what does that mean for you weighing up options for where to get a quote? Well, generally you can expect a faster turnaround time (days not weeks), lower paperwork requirements & no conditions attached before you can access the funds.

Fast Loan Options

Simple Working Capital Loan. You can now get up to €250k in days at rates from 4.75% so long as you are turning over in excess of €100k, are profitable and pass a credit check based on a few simple documents (2 years accounts, 12 months bank statements and the tax clearance certificate.)

Invoice Finance & Trade Finance. The SBCI have allocated funds to a fintech who can release funding based on what you’re owed in your book of debtors. In some instances they can also finance your purchase orders. This keeps vital working capital within your business instead of being tied up while your goods are in transit and then whilst you’re waiting for your customers to pay you.

Asset Finance. A fintech has access to SBCI funds to help businesses get more assets. They have a track record of financing new, old & unusual assets from all over the world. If you have your eye on something to help your business grow you can benefit from a quick decision at a great rate.

BusinessLoans.ie is here for you 7 days to organise fast finance quotes. Talk to us on 01 55 636 55 now.

Business Loans For Growth in 2021

Happy New Year! Now that we’re in to 2021 your business may be planning to survive or even thrive. Key drivers for finance are the pandemic & lockdowns, Brexit readiness, pivoting & general business growth financing requirements. If your business needs financing we’re here to help organise business loan quotes. Depending on what industry you operate in there are government-backed supports & loans to suit most. If not, we have a host of alternative business finance options that can work. BusinessLoans.ie recommends:

Check the Department of Enterprise website for the latest business supports. You may need to revisit their continuity planning checklist to see if you can cover your bases as best you can.

If you need working capital we can get you a quick quote. It costs nothing to get the quote built and you may not even need to draw it down. We have other options that give you a line of credit for trading or releasing value early on invoices when you want to. There is a little bit of work to get you approved for some of these facilities but it can give you peace of mind once you know you can call on it when needed.

If your business would like our new treasury function, please ask. We have a virtual CFO partner who can assist activities such as finance planning, cash flow forecasts and if they identify times when you need more working capital they can queue up reminders to get your finance quotes organised in good time with BusinessLoans.ie.

If you are reviewing your book of debtors and are concerned about not getting paid we’re partnered with a collections company going since 1929, Atradius.

We really are here to help at this time. We never ask you for a fee and get your loan quotes organised quickly. Your accountant or the Local Enterprise Office will be on hand to give you advice too and we always recommend checking in for financial advice on the big decisions. Other than that we have many professionals in our network who we put you in touch with, if it’s not something we are best placed to assist with. Call us 7 days on 01 55 636 55.

Business Loans for Consolidating Debt in Ireland

Recently we had a call from a business owner who was reviewing all their expenses in their business. They were paying a lot of money out on different short-term business loans they had got for purposes of working capital, buying used equipment & a second-hand van. They had too many loan payments and wanted a solution to make repayments more manageable. They wanted to improve their cash flow and have more working capital in their bank account to run their business’s day-to-day outgoings & are now more conscious they need to be ready for business shocks as they arise. Does this sound like you?

The good news is there are a number of business loan options on the market, whether you’re looking at government-backed SBCI options you can most-likely get through your bank or you’re considering using alternative business finance. We have people in our network who are happy to take the pain away of dealing with applications like that. We specialise in non-bank loan quotes and we can often get your approval information organised within 24 hours so you can get on doing what you do best; running your business.

Talk to us today about loan quotes from 6 to 60 months. It can be for purposes not only of consolidating debts but for working capital, capital expenditure & more. So long as your business is generally profitable, is currently trading and can meet the repayments a simple unsecured loan can work. Or if your business has assets that can be used as collateral then we can organised secured loan quotes. We always recommend speaking with your accountant for financial advice on whether business debt is the answer for your situation. These are tough trading times and if there are big judgment calls get proper advice! We have people in our network we can refer you to if you from accountants to business advisors to insolvency practitioners. Call us today on 01 55 636 55. We’re here to help.

A Seasonal Liqueur Business Toasts an Invoice Finance Solution

This week BusinessLoans.ie helped a client in the drinks industry. They make a liqueur that’s especially popular around Christmas, requiring extra working capital to ramp up production to serve their distributors across Ireland, Europe & the USA. They ultimately needed extra funds for October, November & December. They looked at traditional invoice finance options but were put off by ongoing fees throughout the year when they were not going to be using the facility. We discussed one-off invoice financing with them. This would enable them to “cash in” invoices when they need to & without the commitment of an ongoing solution.

So how does it work? Essentially it enables you to release cash trapped in invoices & speed up your working capital cycle. You can pick and choose which invoices to fund 80% payment in 24 hours.

BENEFITS FOR YOUR BUSINESS

No personal guarantees or additional security – funding decision based on the debtor

No long-term contracts, no onerous paperwork

Multiple currencies supported

Fast decisions, fast funding & simple process

Affordable and flexible finance

Bad debt protection

CRITERIA TO ACCESS FUNDING

Your business is trading with limited companies

You have insurable debtors

Your invoices are between €15,000 and €2,000,000

Your business has been trading more than 2 years

Your turnover is more than €500,000

If one-off invoice finance is of interest we’re here to guide you through the process of getting your debtors approved & uploading invoices. You can then receive 80% now and a final settlement when your debtor pays. Talk to the business loans team today on 01 55 636 55 or web chat via the portal in the bottom right of this screen now. We’re here to help, 7 days.

Business Loans in Times of Economic Uncertainty

With headlines to traumatise the Irish economy such as “Covid-19: NPHET recommends State moves to Level 5 restrictions for four weeks”, it makes me think of something my business mentor told me, about borrowing money when you don’t need it & being ready for unexpected situations. Let’s look in to it?

How much working capital does a small business need?

The amount of working capital a small business needs to run smoothly depends largely on the type of business, its operating cycle, and the business owners’ goals for future growth. However, while very large businesses can get by with negative working capital because of their ability to raise funds quickly, small businesses should maintain positive working capital figures.

Assuming you passed the debt-service ratio test, when should you borrow money for your business?

You should borrow when you are confident that you can make more profit as a result of borrowing money. Estimate what your sales and profits are before borrowing and what they will be after you borrow.

What is a good debt-service ratio?

A debt-service coverage ratio of 1 or above indicates that a company is generating sufficient operating income to cover its annual debt and interest payments. As a general rule of thumb, an ideal ratio is 2 or higher. A ratio that high suggests that the company is capable of taking on more debt.

In times of uncertainty or when a business really needs money is generally the time when underwriters will class the situation as high-risk and decline an application / apply a higher rate. That’s why businesses need to be sufficiently financed to handle shocks. Hopefully that working capital comes from retained earnings however, there are times when you will need that from supports, grants or debt. Always speak with your CFO or accountant to advise you on what’s right for your situation. There are a number of government-backed supports you can read about in our post here. Or if you want to look at fast finance quotes from alternative lenders we can assist. You can get an idea of the different loan types in our post here. We’re here for you 7 days to talk finance on 01 55 636 55.

References:

https://www.irishtimes.com/news/ireland/irish-news/covid-19-nphet-recommends-state-moves-to-level-5-restrictions-for-four-weeks-1.4371810

https://corporatefinanceinstitute.com/resources/knowledge/finance/debt-service-coverage-ratio/

https://www.investopedia.com/ask/answers/102915/how-much-working-capital-does-small-business-need.asp

Bad Debt Collection Help in Ireland

Lately we have been hearing from our clients that they are having issues with difficult debtors. It’s a sign of the times we’re in due to the economic difficulties ensuing from COVID-19. We decided to research the best B2B debt collection service in the Irish market and we are pleased to announce our partnership with Atradius Collections B.V.

Their process is online and extremely simple. Firstly you get a free quote; then upload your overdue invoices; finally you submit your case. Your case is then placed with an Atradius Collections local collector commences initially “amicable debt collection” and communicates with your debtor. You, as an Atradius Collections customer, are assigned an Account Manager to discuss your case updates and progress. What this means is early on in the process it doesn’t get too legalistic. Your debtor will receive emails, letters & calls; but don’t mistake this to think this part of the process has no teeth. Atradius is one of the world’s biggest credit insurance companies and even if you’re the “little guy” getting bullied by the “big debtor” refusing to pay, they handle David & Goliath situations with ease. By engaging with a collections agency that’s also a huge credit insurer means they could ultimately hurt your debtor’s ability to get access to finance in future by blacklisting credit insurance services. In addition, Atradius hold information on 200 million companies worldwide! Debtors will often see that it’s better to pay you.

It costs nothing to get set up on their system and you can call it in to action when needed. Just ask us and we will arrange it. Or if you would like to get a free quote click here.

BusinessLoans.ie for Fast Loans in Ireland

If you are a business owner in Ireland you may have had the experience of waiting longer than expected to hear news on your bank loan application. This form of purgatory is often called the “slow no”. You’re not hearing no; your hopes are still alive that you will get approval; perhaps the bank has requested a couple of extra pieces of information that you’ve quickly responded with, giving you a glimmer of hope. The “slow no” is a torturous experience that you wouldn’t wish on your worst enemy. This is especially true when you’re trying to plan for a project that needs finance in these tough trading times.

The good news is we often speak with business owners in this very pickle. If they want fast finance quotes there are a host of alternative lenders whose processes, using the latest Fintech systems, are often swifter than the banks. They have tailored solutions for various business challenges. The team at BusinessLoans.ie has a great relationship with the credit teams and know how to present the information to get your quote approved quickly & efficiently. So if you need a quick quote give us a call 7 days on 01 55 636 55 or web chat via the box on the bottom right of this page.